Managing finances is essential for growth and sustainability. RBC Wealth helps out different categories of clients and businesses manage their finances. In this article, we will look into the services provided by RBC and further discuss its competitive advantage in the market.

About RBC Wealth

RBC Wealth is one of the leading firms that offer specialized services in investment planning, estate planning, retirement planning, and private banking. In every step taken by RBC Wealth in managing your finances they account the long-term goals you wish to achieve.

The Wealth Management caters to an extensive array of clients that include families, corporations, and affluent people. Its services allow for the accumulation, protection, and distribution of wealth over a multitude of generations. RBC utilizes its financial proficiency, advanced technology, and constantly changing market conditions and clients’ unique ideas to achieve the desired goals.

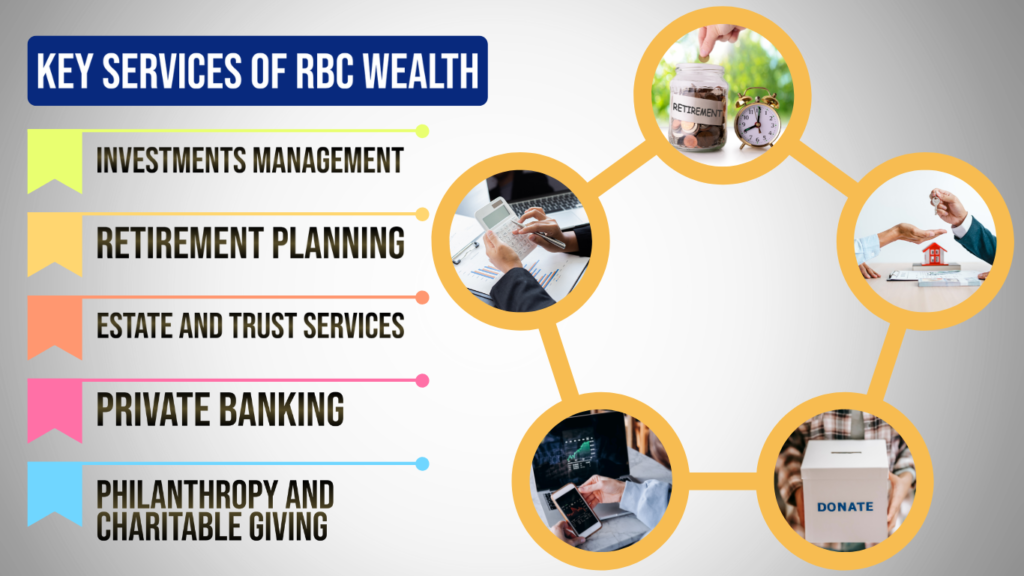

Key Services

RBC Wealth Management offers a variety of services that enable businesses and individuals to effectively achieve the desired milestones or goals and grow their wealth.

Investment Management

At RBC, investment services are offered as per the client’s risk profile and investment objectives, which may include a portfolio of equities, bonds, mutual funds, and other investing alternatives. The investment approach seeks to achieve the best possible returns consistent with the risks, so that the clients attain reasonable and sustainable growth in the long term.

Retirement Planning

The clients are offered bespoke retirement plans that prepare retirees for the next phase of life in a financially sound manner. Advisors liaise with the clients to understand their retirement and lifestyle goals, and devise an action plan which focuses on saving more, tax efficiency, and long-term financial growth.

Estate and Trust Services

RBC supports the clients in estate planning to ensure effective intergenerational wealth transfer with tax optimization. The Trust services help in the protection and preservation of wealth by putting in place legal and financial mechanisms for effortless succession of assets and provisions for future generations.

Private Banking

High net-worth clients can obtain customized banking services that can include tailor made lending facilities, managed accounts, and investment portfolios built around their specific requirements.

Philanthropy and Charitable Giving

RBC helps clients set up charitable foundations and impactful philanthropy projects. The guides educates the clients on how to strategically give to charitable organizations in the manner that supports the clients’ financial objectives and principles while maximizing the desirable impact of giving.

What Makes RBC Wealth Different

Global Reach and Expertise

It has a presence in all major markets, which allows for international investments and a variety of financial services. It allows clients to tap a plethora of global markets and utilize different global economic activities.

Client-Focused Approach

Every client comes with different goals and objectives and they take pride in serving each client with a distinct financial plan that fulfills their primary aspirations. Advisors base the long-term relationships on trust, transparency, and comprehensive service.

Innovation in Wealth Management

They uses technology to enhance financial solutions and investment strategies. With digital platforms and AI-powered insights, clients are equipped with real-time data and analytics to make the best decisions regarding their money.

Commitment to Responsible Investing

RBC Wealth actively considers ESG factors alongside their investments. Clients are increasingly being offered the opportunity to invest sustainably while still obtaining excellent investment returns.

How to Get Started

It is incredibly simple to get started with RBC Wealth. Clients need to meet with an RBC Wealth advisor first to define their financial goals and then come up with a personalized plan which will include a full financial evaluation to pinpoint opportunities to grow, manage risk, and ensure long term safety.

Clients have the option to use RBC Wealth’s digital services, which provide access to a client’s portfolio, market information, and investment suggestions in real-time. Technology helps incorporate transparency which enables clients to make informed decisions proactively.

Final Thoughts

Wealth management industry leaders, RBC Wealth offers an unrivaled approach to financial management, investment, and customer service. No matter if you’re hunting for the right retirement strategy, investment growth, or building a legacy, you are guaranteed to receive adequate guidance from RBC Wealth throughout your financial journey.

Choosing RBC Wealth gives clients the spoils of powerful advisors, inventive finances, and commitment to ethical investing. Comprehensive wealth management services of the firm provide certainty that all financial activities will correspond with the requirements and living goals of the clients.